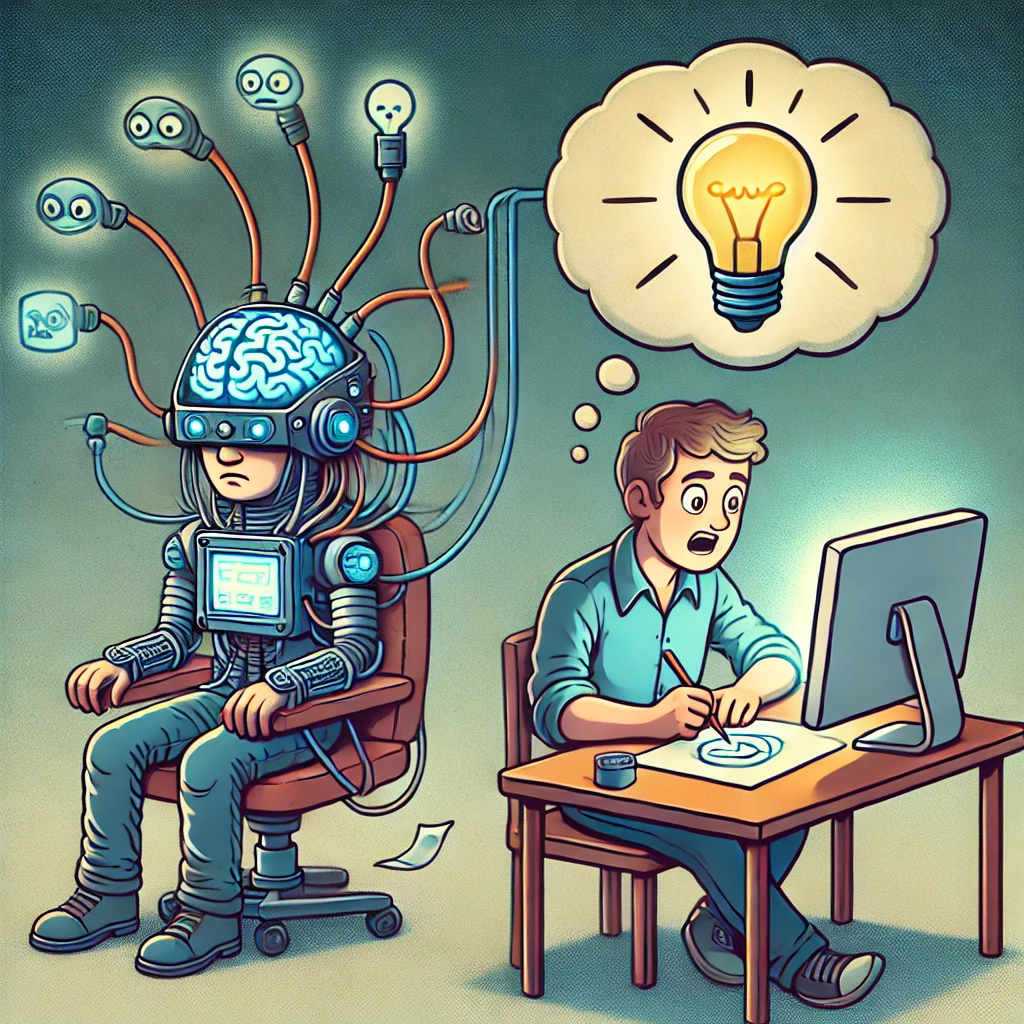

Brain-Computer Interface (BCI) technology has vast potential, but if misused, it could potentially hinder the spirit of innovation and creativity. Here’s how:

- Surveillance and Control:

- Monitored Thoughts: If BCI technology is used to monitor or control thoughts or mental states, it could lead to surveillance of the creative process, stifling free thought and expression.

- Creativity Inhibition: By limiting or modifying a person’s thoughts, the very essence of free-will and unstructured creativity could be constrained, making it difficult for individuals to freely explore and innovate.

- Intellectual Property Theft:

- Brainwave Hacking: In a world where BCI is integrated with creative processes, malicious entities could potentially access, copy, or steal innovative ideas directly from someone’s mind.

- Ideas without Protection: With direct access to thoughts, the concept of intellectual property could become more vulnerable, potentially eroding protections for creators and innovators.

- Dependence on Technology:

- Over-reliance: If individuals start to depend too much on BCI devices to aid in their creativity or problem-solving, it might reduce their ability to come up with ideas independently, stifling natural creativity.

- Narrowed Focus: BCIs might also narrow a person’s thought process, leading to over-optimized, predictable solutions, rather than allowing for the free and often chaotic flow of ideas that sparks creativity.

- Ethical Concerns and Bias:

- Bias in AI Integration: BCIs could potentially introduce bias in creative work, particularly if they are paired with AI systems that prioritize certain types of ideas or outcomes over others.

- Manipulation: If BCIs are used to guide someone’s thinking or creativity in a particular direction (either for profit or other motives), it could be seen as manipulation, steering people away from true, authentic innovation.

- Loss of Human Touch:

- Over-technical Solutions: Creative projects are often born out of human emotion, intuition, and spontaneous moments. Over-reliance on technology like BCIs could risk reducing these human elements, leaving behind innovation that feels mechanical and less connected to human experience.

- Over-engineering: Technology should enhance creativity, not limit it. If BCI leads to a highly structured or engineered approach to creativity, it may eliminate the unpredictability that fuels innovation.

Conclusion:

BCI could significantly affect innovation and creativity if it is used to control, monitor, or limit free thought, making it essential to create ethical guidelines and safeguards. It should be used to enhance and augment human creativity, not replace it or stifle it.